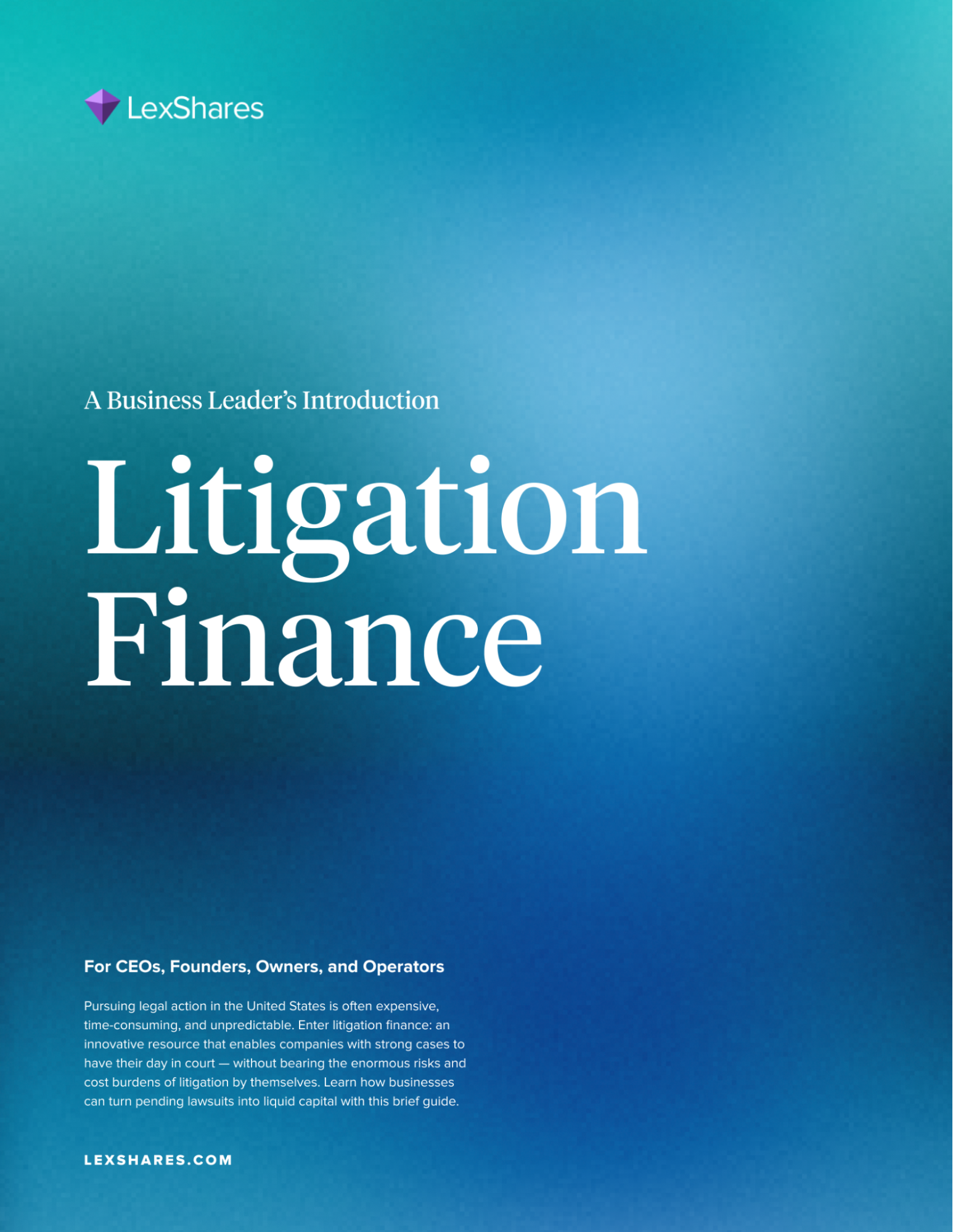

Financial strength for your litigation

Non-Recourse Funding$200K - $5M+Single Cases & Portfolios

With LexShares, you are backed by the stability and experience of a litigation finance leader.

Innovative financial products for your litigation

Reduce Risk

With fully non-recourse funding, there is no obligation to repay if the case is lost.

Control Costs

Open up alternative fee arrangement possibilities for clients with limited access to capital.

Optimize Outcomes

Financing helps litigants stay the course without settling for less than the damages merit.

$100 million funded, and counting

Since its inception in 2014, LexShares has provided strategic capital to a wide range of companies and law firms to help them pursue their legal claims.

Breach of Contract

$1,500,000

The defendant allegedly breached a licensing agreement, failing to comply with its obligations to develop, market, and sell the plaintiff's product.

Single CaseTheft of Trade Secrets

$2,300,000

Fortune 500 defendants allegedly misappropriated the plaintiff's trade secrets after executives breached multiple non-disclosure agreements.

Single CaseLaw Firm Funding

$4,000,000

A law firm funding arrangement collateralized by a portfolio of cases in the pharmaceutical industry.

PortfolioSettlement

$3,500,000

A settlement acceleration arrangement involving multiple real estate disputes related to an executed settlement.

Single CaseBreach of Fiduciary Duty

$475,000

A government entity, in its capacity as trustee, allegedly breached its duties to the plaintiff by mismanaging key assets.

Single CaseFraud

$2,000,000

The defendants allegedly defrauded the plaintiffs by squeezing them out of their equity interest in the company.

Single CaseHow our process works

Reach out to our team to start discussing whether funding is right for your legal claim.

1

Initial Review

Our team works efficiently to provide feedback on your legal claim. If we believe the case is suited for funding, we will present a term sheet.

1 - 2 WeeksSample Legal Claim

Case Type

Breach of Fiduciary Duty

Shareholders of Sterling Cooper allege the agency's financial advisors failed to disclose significant conflicts of interests with a rival firm after a recent acquisition.

Damages

$20,000,000

Defendant

Cutler Gleason Chaough

Owners of a large M&A advisory firm tasked with finding the best possible buyer for Sterling Cooper to prevent the agency from being sold below fair market value.

2

Claims Assessment

Once material terms are solidified and deal documentation is executed, the claim is assessed.

3 - 4 WeeksSample Diligence List

Engagement Agreement

Documents outlining the plaintiff’s engagement structure with counsel.

Damages Analysis

Information supporting how the expected damages were calculated by the legal team.

Projected Litigation Budget

Budget projections for various upcoming legal fees, court costs, expert reports, etc.

3

Funding

After the claims are assessed, a notice of approval may be provided, followed by swift and secure delivery of funding.

1 Week100% Funded

$2.00M

Closed

Non-Recourse Funding

There is no obligation to repay LexShares’ investment if the case is lost.

Learn the concepts, structures, pricing models, and more

Our comprehensive library of litigation finance content covers everything from introductory concepts to detailed regulatory analysis.

View ResourcesOne of the most active funders in the industry

Through a combination of proprietary technology and an experienced team, LexShares has become a global leader in litigation finance.

Speed and professionalism

Our team features many former litigators with deep experience evaluating case merits and structuring litigation finance investments.

View TeamDiscuss funding with LexShares.

To discuss a potential funding need for your business or law firm, please contact us below.